OVERVIEW

Traditional banking infrastructure often struggles to keep up with modern digital businesses. Our client wanted to fix this with a complete white-label solution that helps startups and entrepreneurs launch their own banking services. We built a platform that removes the usual complexity and high costs, giving them a much faster path to market.

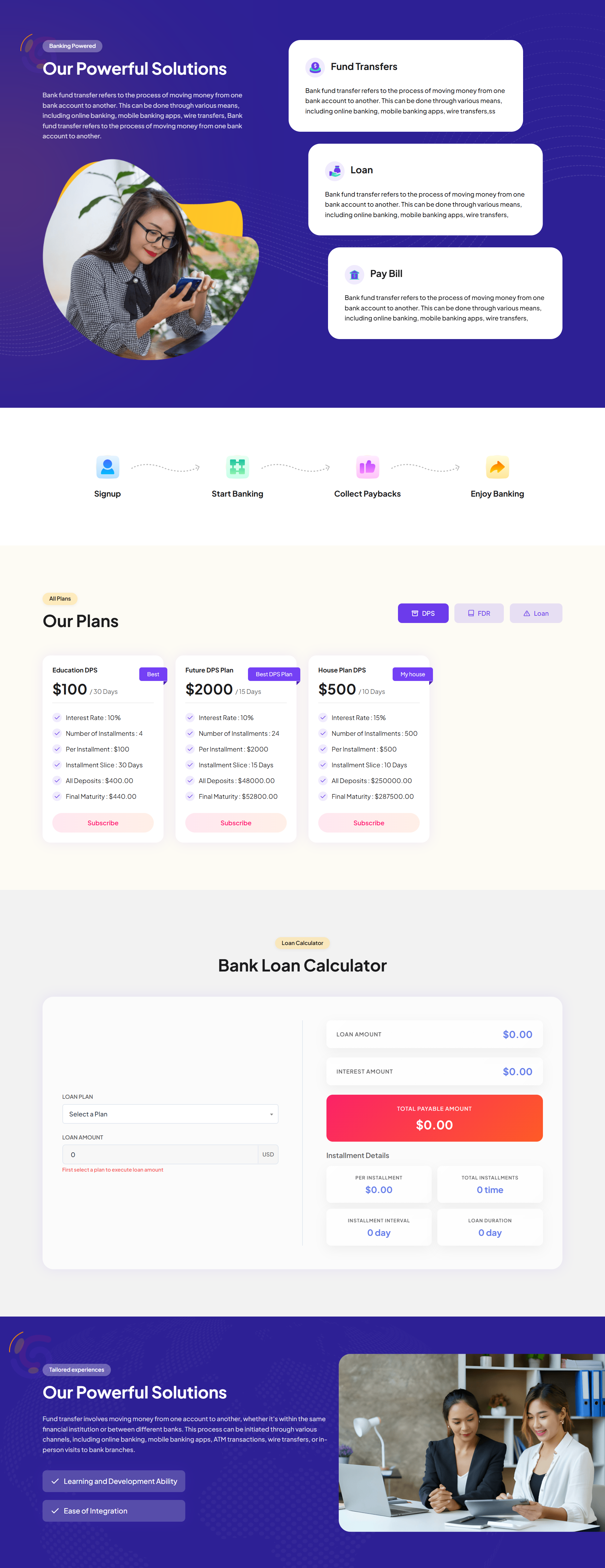

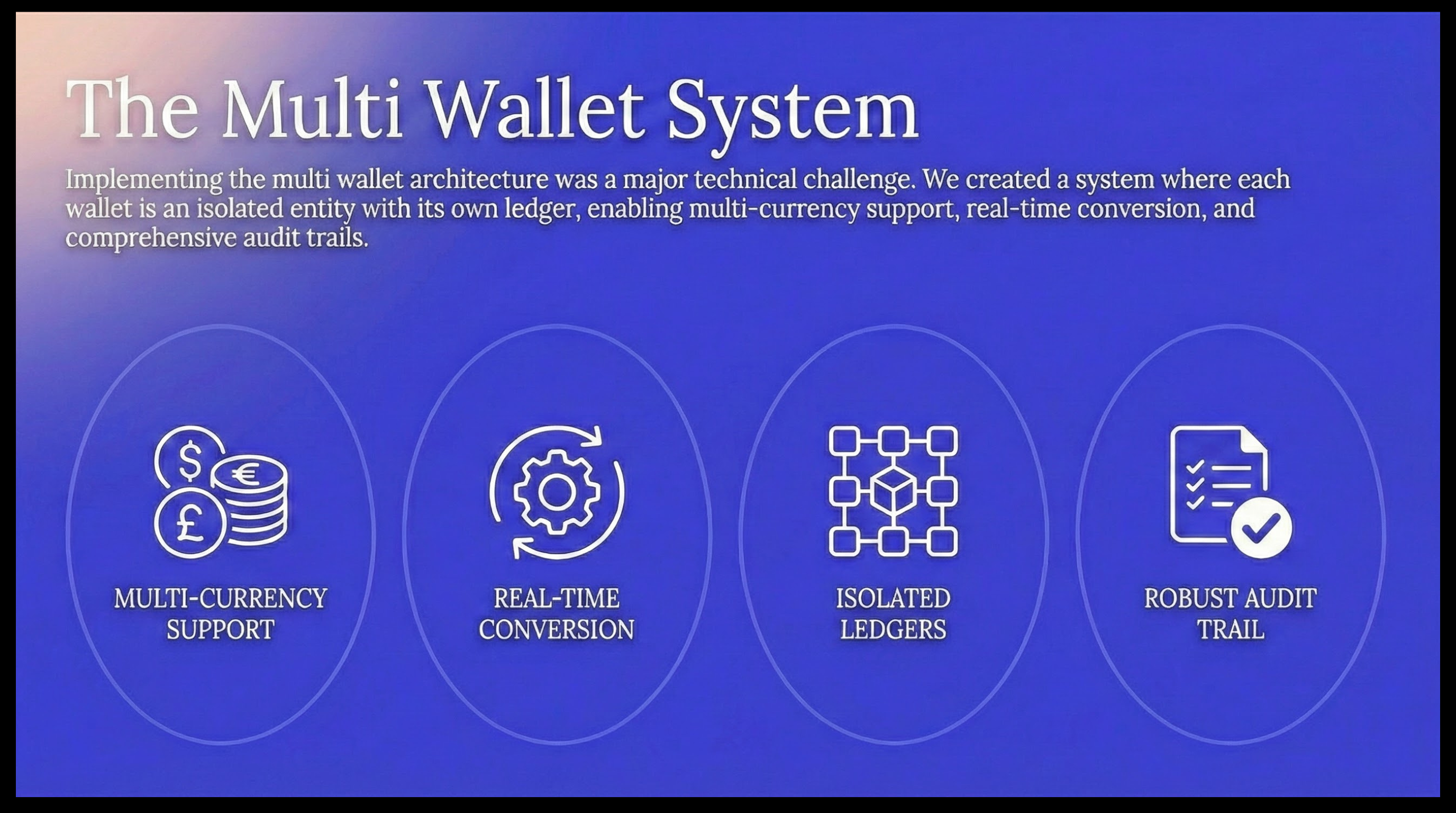

The main goal was balancing absolute security with flexibility. We developed a system that handles multi-currency transactions, loans, and deposits all in one place. Beyond the technical specs, we focused heavily on the UX—creating an interface that feels intuitive and trustworthy, which is critical when users are managing their money.

Our Approach

FOUNDATIONAL RESEARCH

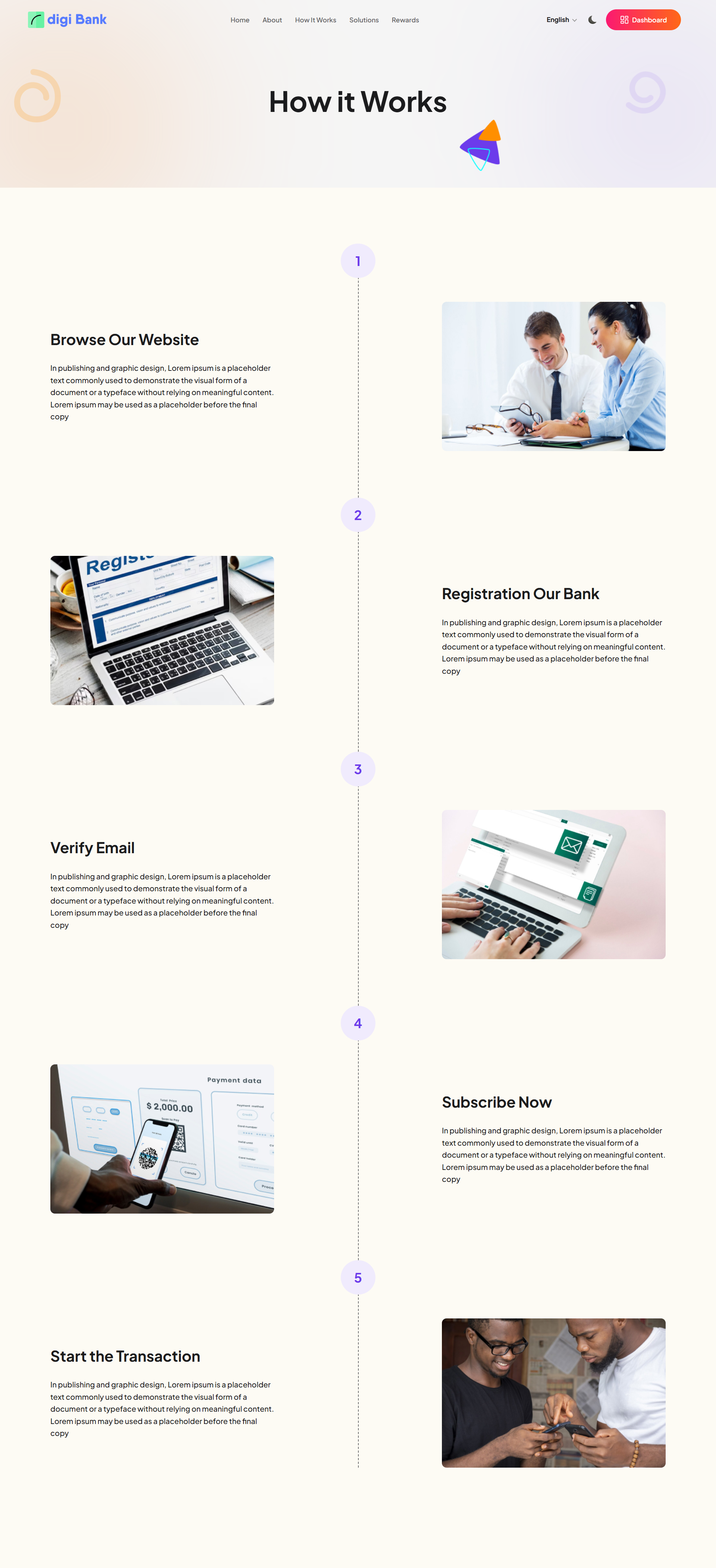

Conduct an eight-week deep dive into market analysis and regulatory requirements to build a solid, compliant framework for the platform.

JOURNEY MAPPING

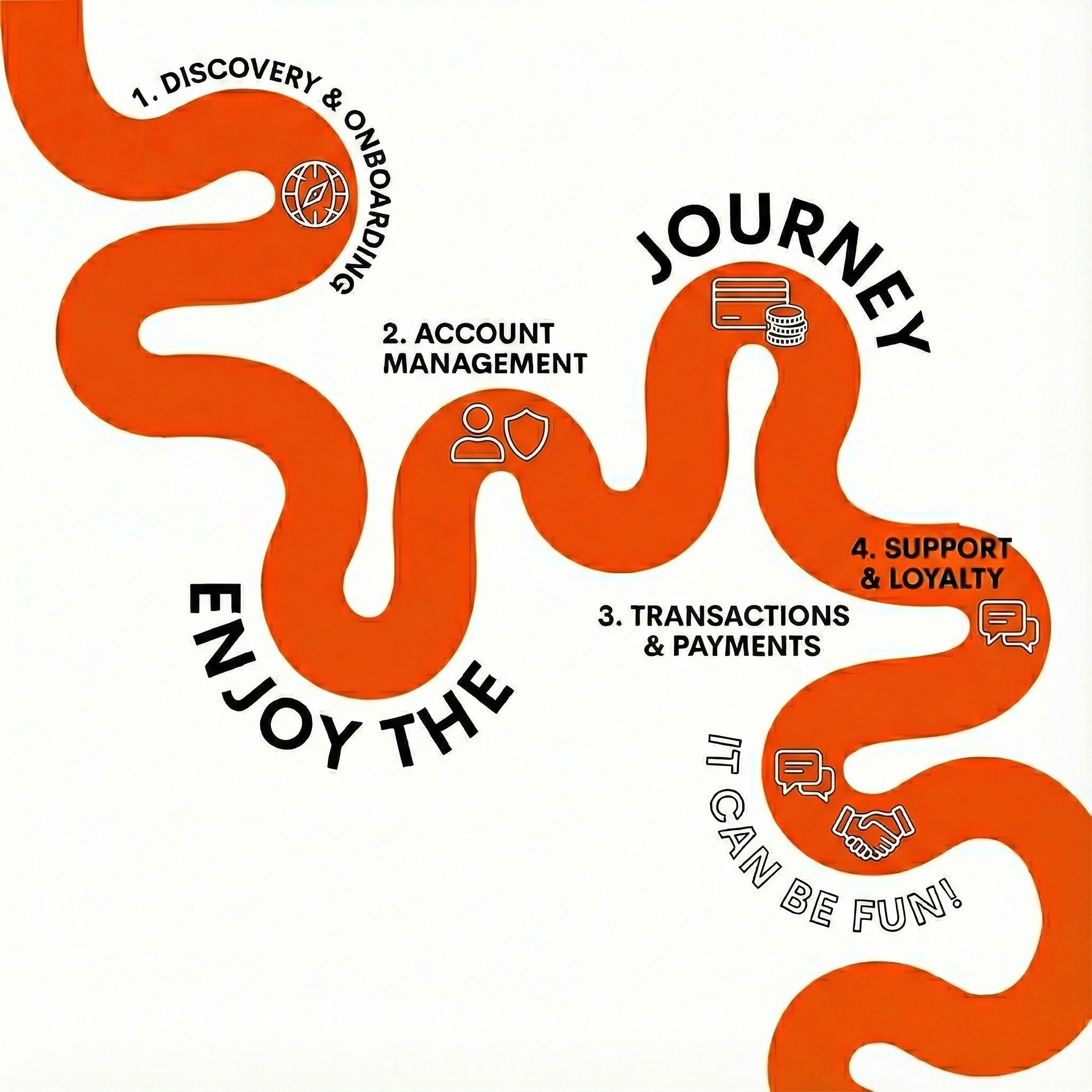

Map every user interaction before development begins—from onboarding to complex loan flows—to ensure a seamless and logical experience.

ROBUST ARCHITECTURE

Prioritize security, scalability, and maintainability to ensure the system protects user data and handles rapid growth without needing a rebuild.

Technical Foundation

CORE ARCHITECTURE

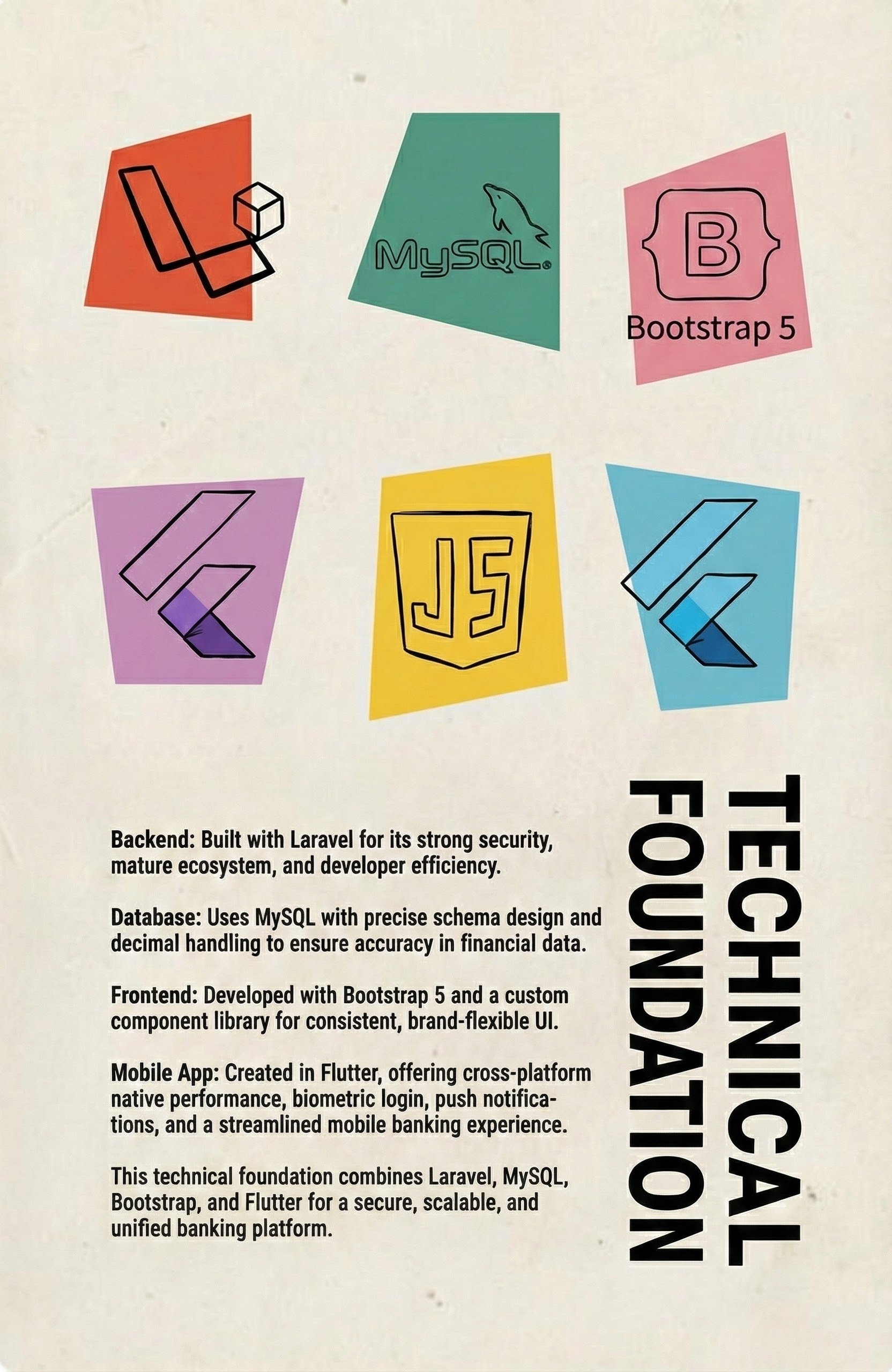

Leverage Laravel and MySQL to build a secure, scalable backbone that handles complex data relationships and ensures absolute precision in financial calculations.

ADAPTABLE DESIGN

Create a modern, component-based frontend with Bootstrap 5 that ensures visual consistency while allowing easy branding customization for white-label partners.

MOBILE PERFORMANCE

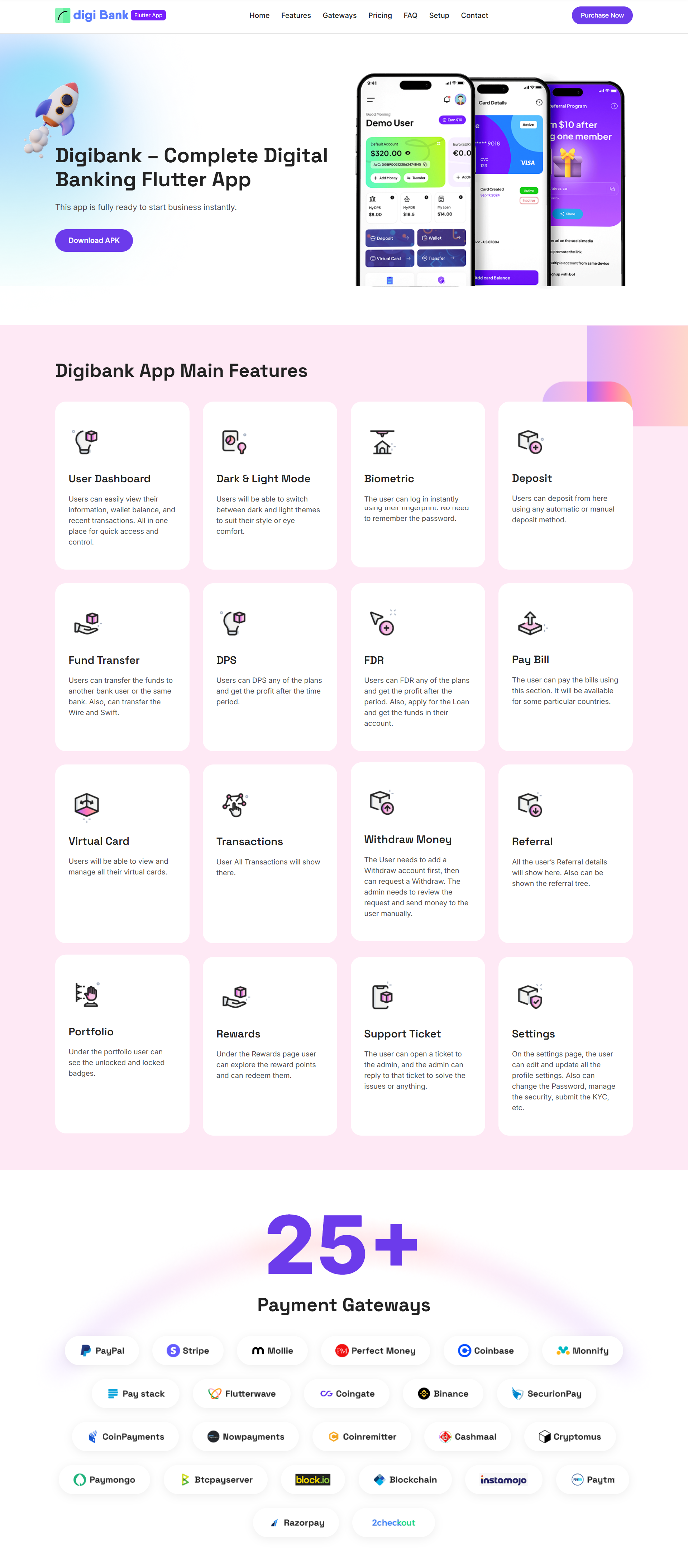

Deploy a cross-platform Flutter app to deliver native features, like biometrics and real-time alerts, on both iOS and Android from a single, efficient codebase.

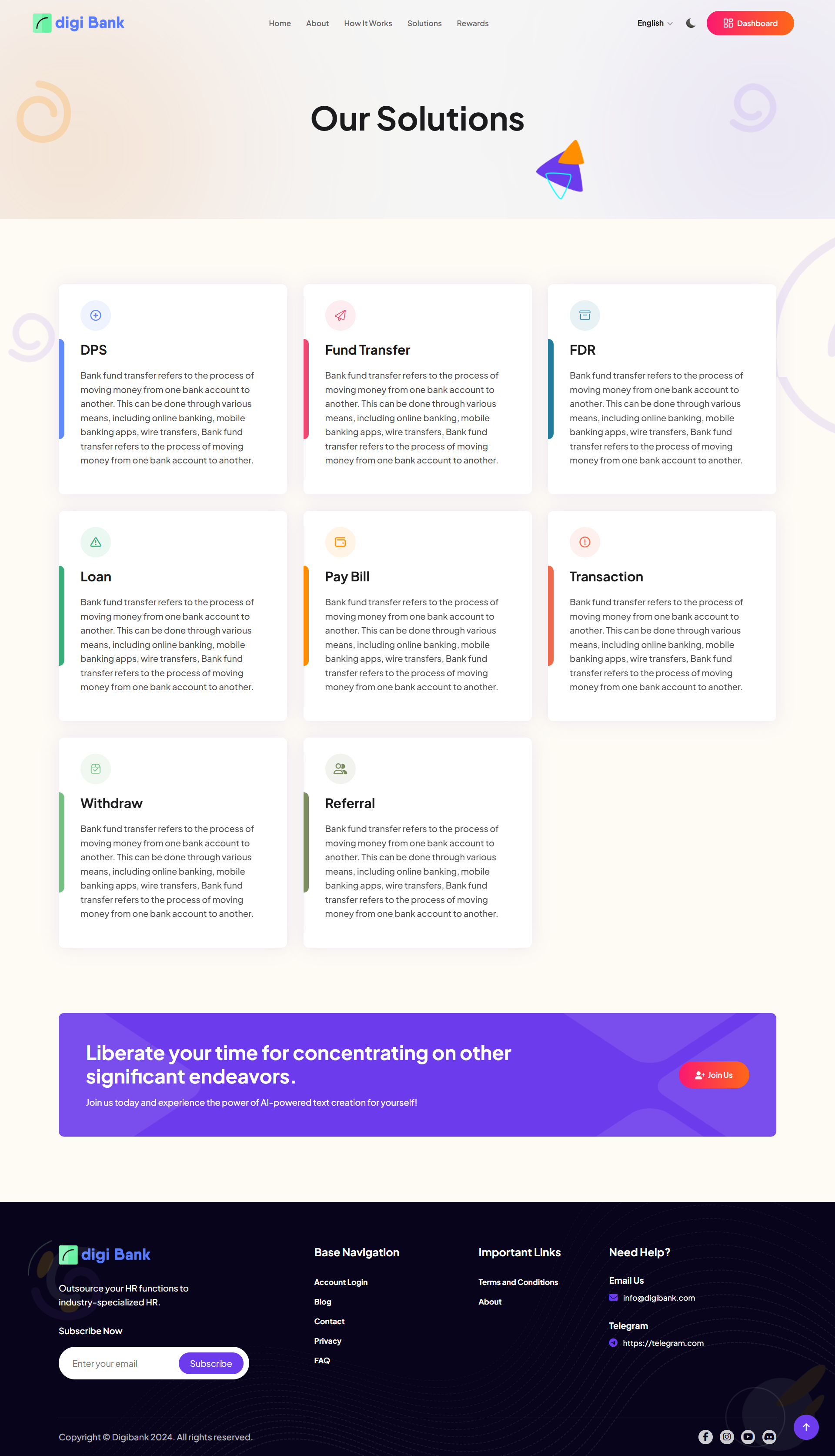

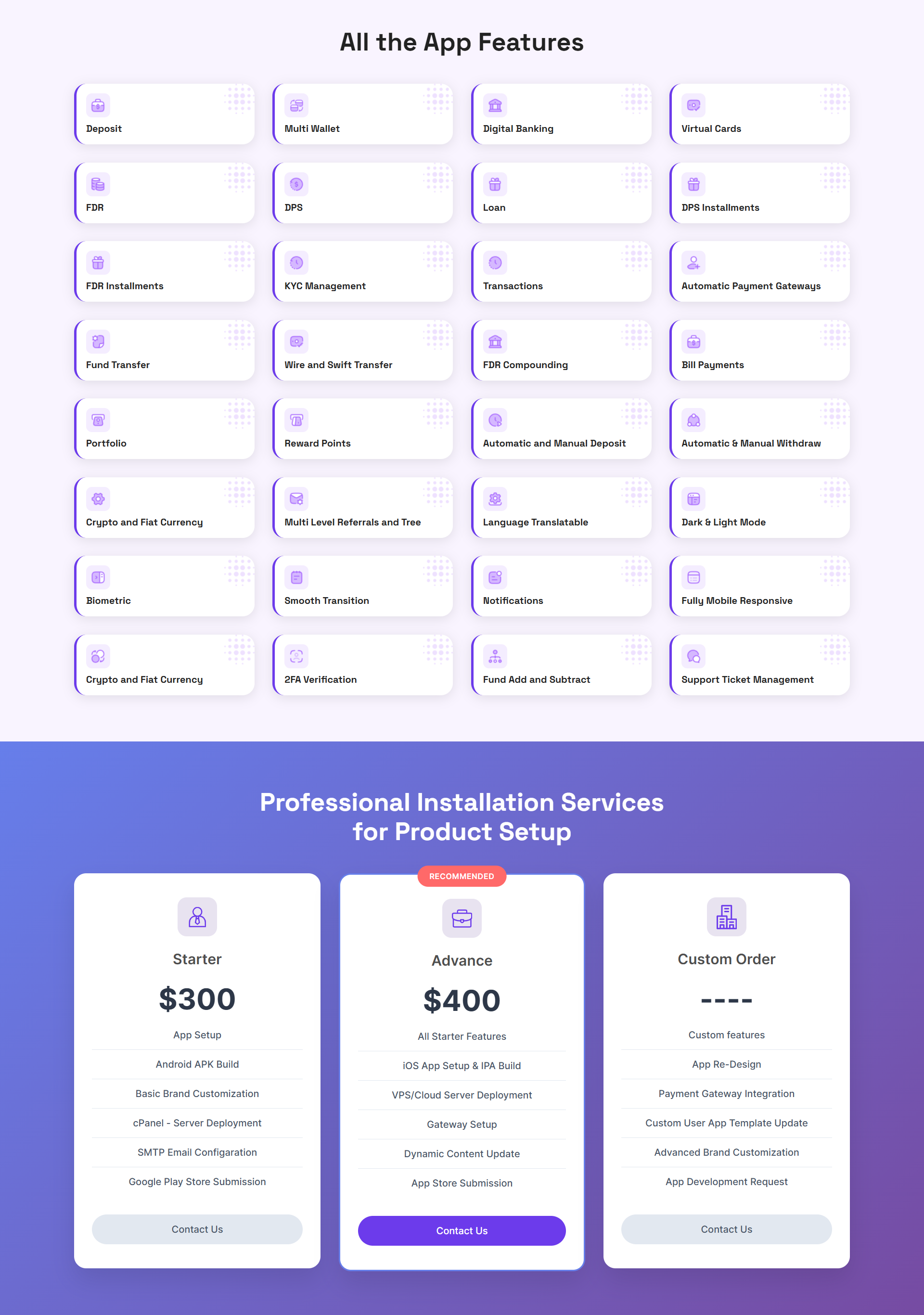

CORE FEATURES

PHASES

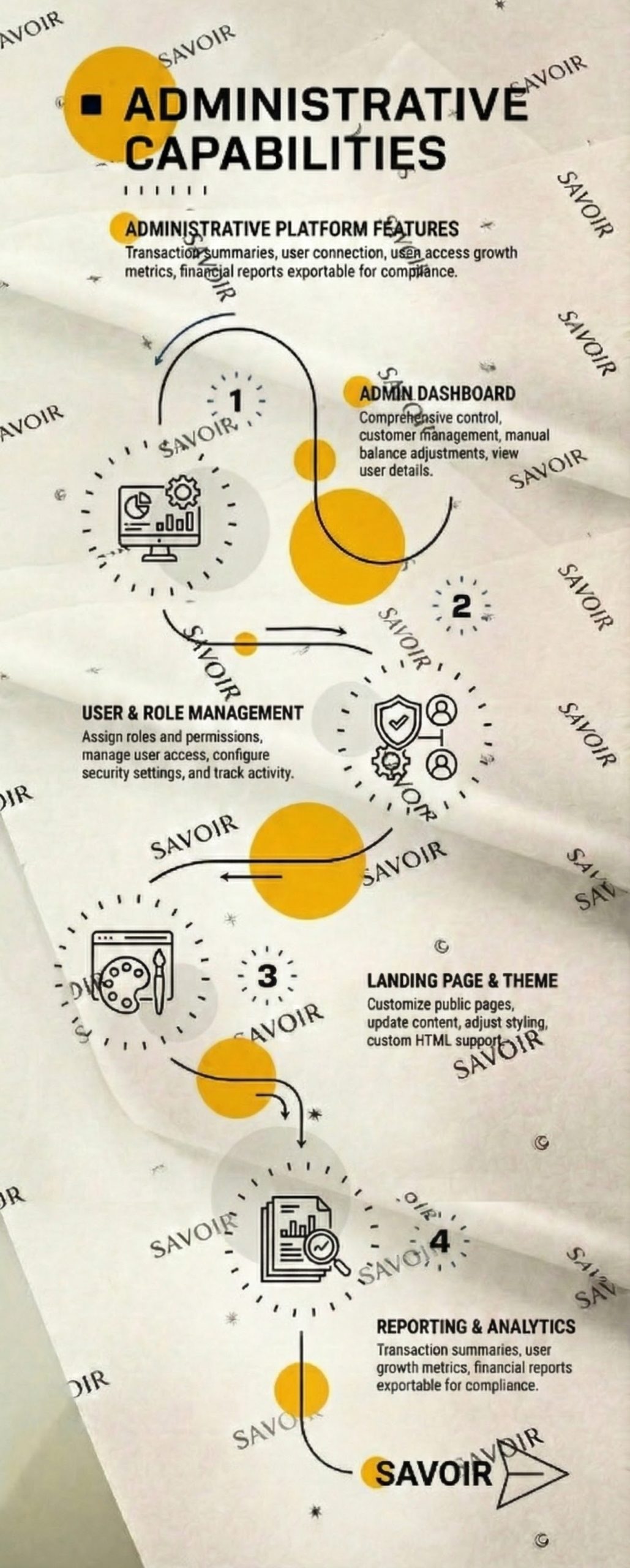

Administrative Capabilities

-

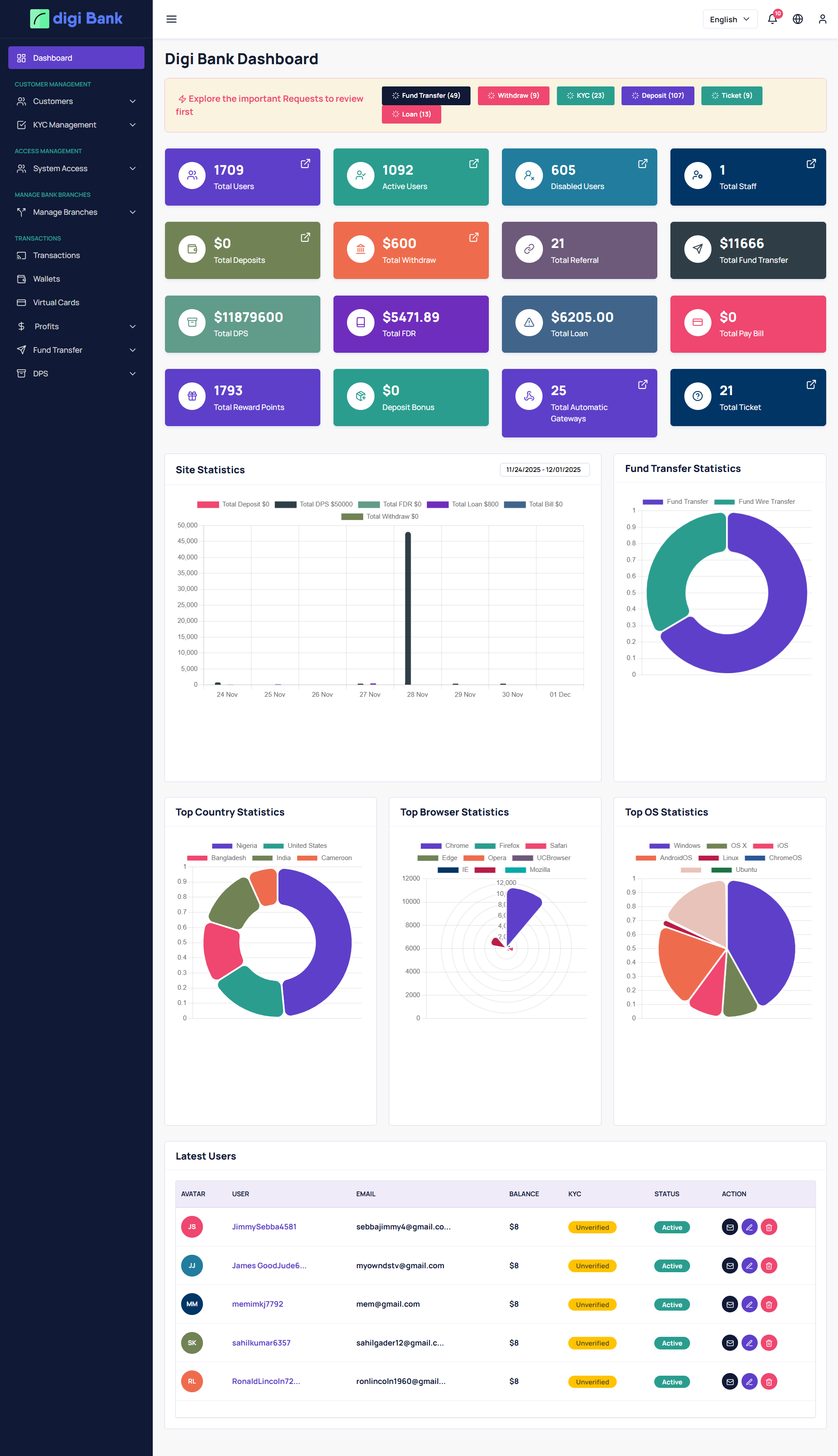

Customer Management and Account OperationsCustomer management includes rich customer profiles with full account history, registration details, and verification status. Administrators can quickly find users with advanced filters, review transactions, manage account status, adjust balances with appropriate approvals, communicate with customers, and handle refunds or reversals, with every change logged for transparency.

-

Know Your Customer and Verification ManagementThe KYC module supports detailed document review with tools for close inspection and comparison, plus checks against government and external databases. OCR helps extract information, but final approvals remain human-led, supported by workflows, sanction screening, document authenticity checks, ongoing monitoring, and risk scoring that shapes limits and verification levels.

-

Payment Gateway Configuration and ManagementNon-technical teams can configure and manage multiple payment gateways through a simple interface. Credentials are encrypted, gateways can be enabled or disabled independently, health indicators track connectivity, and routing rules direct transactions based on factors like ticket size, geography, or customer profile.

-

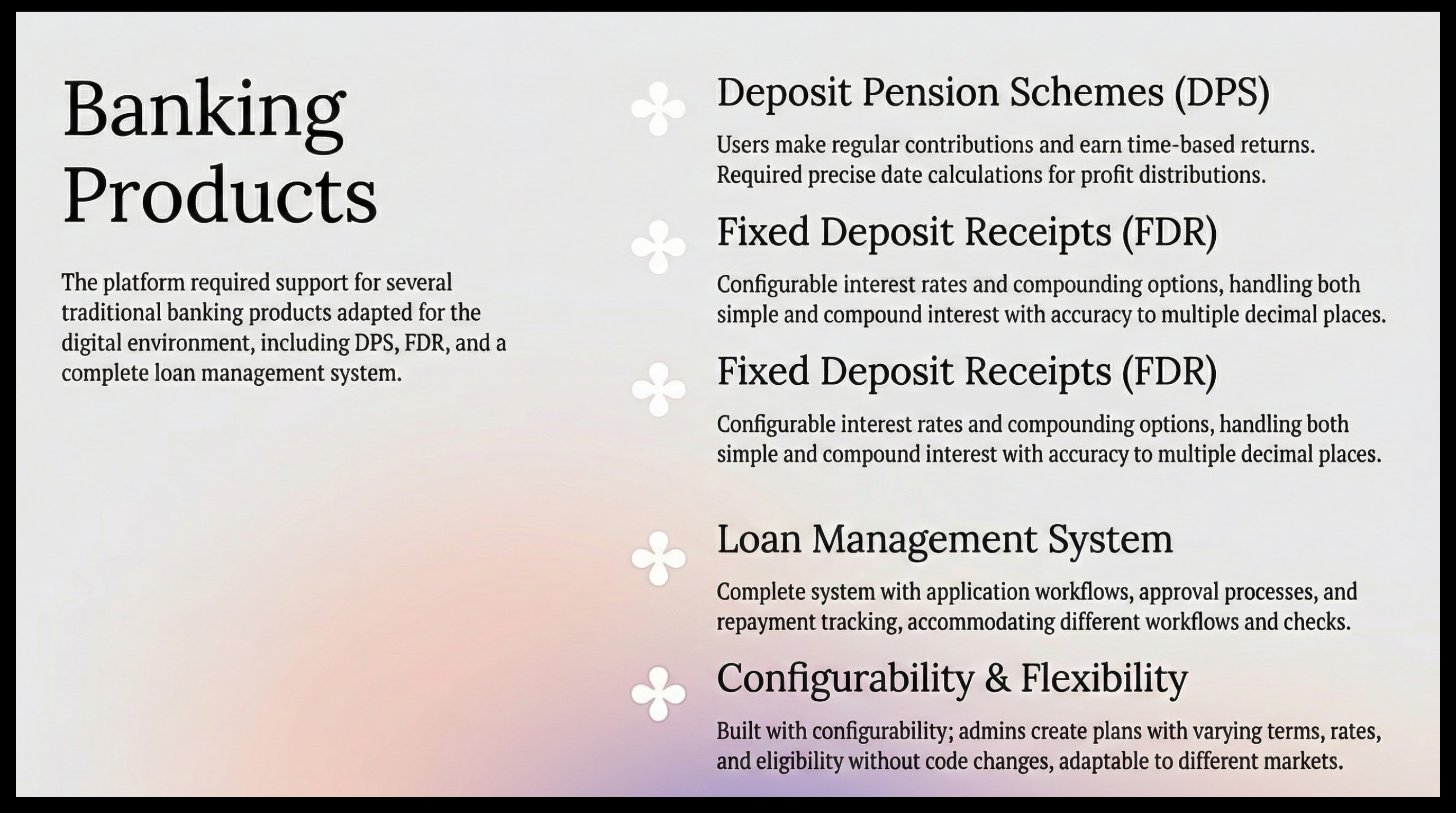

Banking Product ConfigurationAdministrators can configure DPS, FDR, and loan products with tailored parameters, eligibility rules, and built-in calculators for projected returns. Product versioning keeps existing customer terms intact while allowing new offers to roll out cleanly, with eligibility checks enforced automatically across the platform.

-

Landing Page and Website ManagementA no-code landing page builder lets teams assemble hero sections, features, testimonials, and FAQs while customizing content, colors, typography, and imagery. Responsive previews show how pages render across devices, and version history provides a clear record and rollback options for design and compliance needs.

-

Theme Management and BrandingTeams can choose from multiple pre-designed themes and adapt them to match brand guidelines with logos, colors, fonts, and favicons. For more advanced use cases, custom HTML templates can be uploaded, keeping the same dynamic variable structure so branding and content stay consistent across the platform.

-

Email and Notification TemplatesAll system communications—such as registration confirmations, password resets, alerts, and verification updates—are managed through configurable templates. Each template supports dynamic variables, multiple languages, and SMS-friendly versions, ensuring messages stay clear, concise, and on-brand across channels.

-

Comprehensive Reporting and AnalyticsAdministrators can generate detailed transaction, user, and financial reports with flexible filtering and export options. Summary views highlight volumes, values, success rates, user growth, financial flows, and compliance metrics like KYC completion to support both operational decisions and regulatory reporting.

-

User and Staff ManagementStaff accounts are created with granular roles and permissions so team members only access what they need. Detailed action logs record who did what and when, supporting accountability, separation of duties, and quick investigation of any suspicious or unauthorized behavior.

-

System Settings and ConfigurationPlatform settings cover core information, security policies, and integration details in one place. Teams can manage branding basics, security parameters, email infrastructure, payment defaults, transaction limits, and external service connections for KYC, AML, and other third-party providers.

-

Audit Logging and ComplianceEvery administrative action is recorded with the actor, time, change details, before-and-after states, and IP address. This immutable log supports audits, investigations, and regulatory reviews, with tools to search, filter, and export records in formats suited for oversight bodies.

-

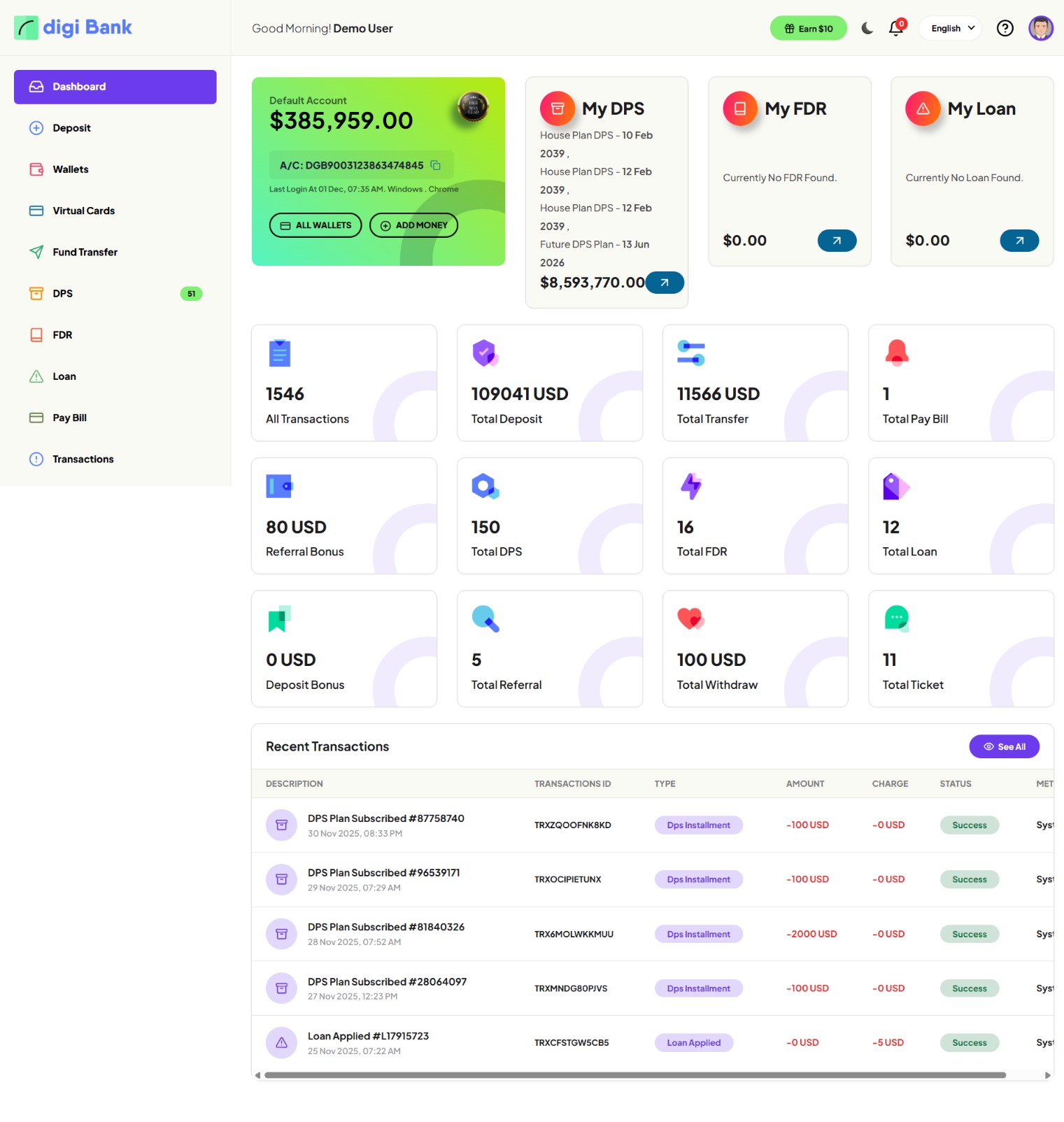

Dashboard Analytics and Key Performance IndicatorsThe main dashboard highlights live KPIs like active users, new signups, balances, volumes, and average transaction sizes with trend views. Alerts surface failed payments, KYC issues, gateway problems, and suspicious activity, while task lists show pending reviews so teams can prioritize fast-moving items.

-

Workflow Management and ApprovalsConfigurable workflows support approvals for sensitive operations, such as high-value loans, large balance adjustments, and customer complaints. Multi-step review and escalation ensure no single administrator can push through critical changes without oversight, and each step is documented.

-

Multi Currency and Multi Language SupportAdministrators can work with multiple currencies using live exchange rate updates and localized reporting views. The interface and templates support multiple languages, so teams in different regions can operate in their native language while keeping the platform fully aligned across markets.

Mobile Application

Optimized for touch navigation, offline access, and light/dark modes to match user preferences.

The Flutter app mirrors the full capabilities of the web platform while optimizing for mobile use. It offers biometric login for quick, secure access and push notifications to keep users updated on transactions and account activities. The interface is touch-friendly, with streamlined navigation and optimized forms for easy use. Offline access lets users view balances and transactions even without connectivity, and both light and dark modes are supported to suit user preferences.

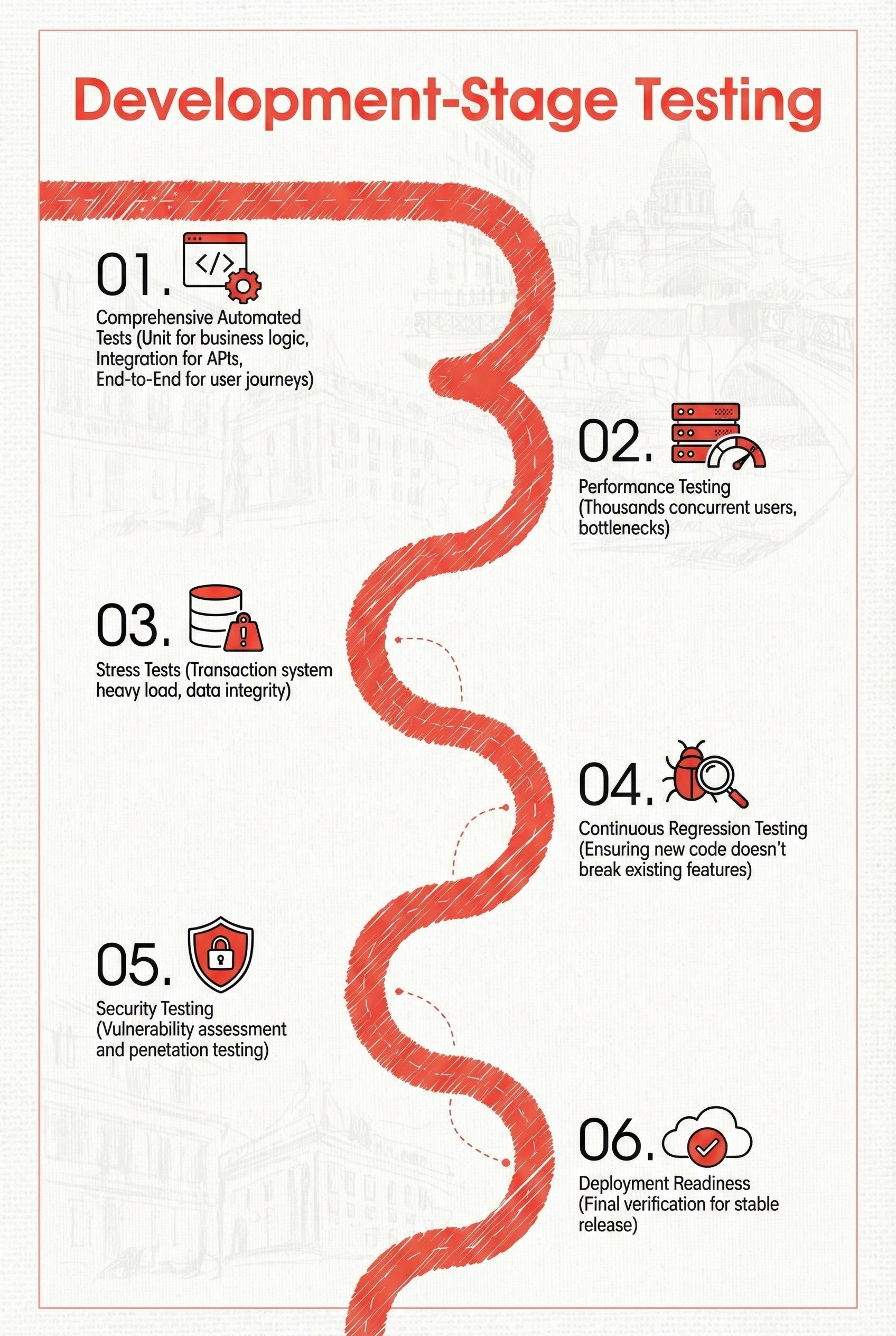

Testing & Quality Assurance

Redefining

Digital Craftsmanship

Our QA process covered every angle, from automated unit tests validating core logic to end-to-end tests simulating real user journeys. Performance and stress testing ensured seamless operation under heavy loads, crucial for transaction integrity.

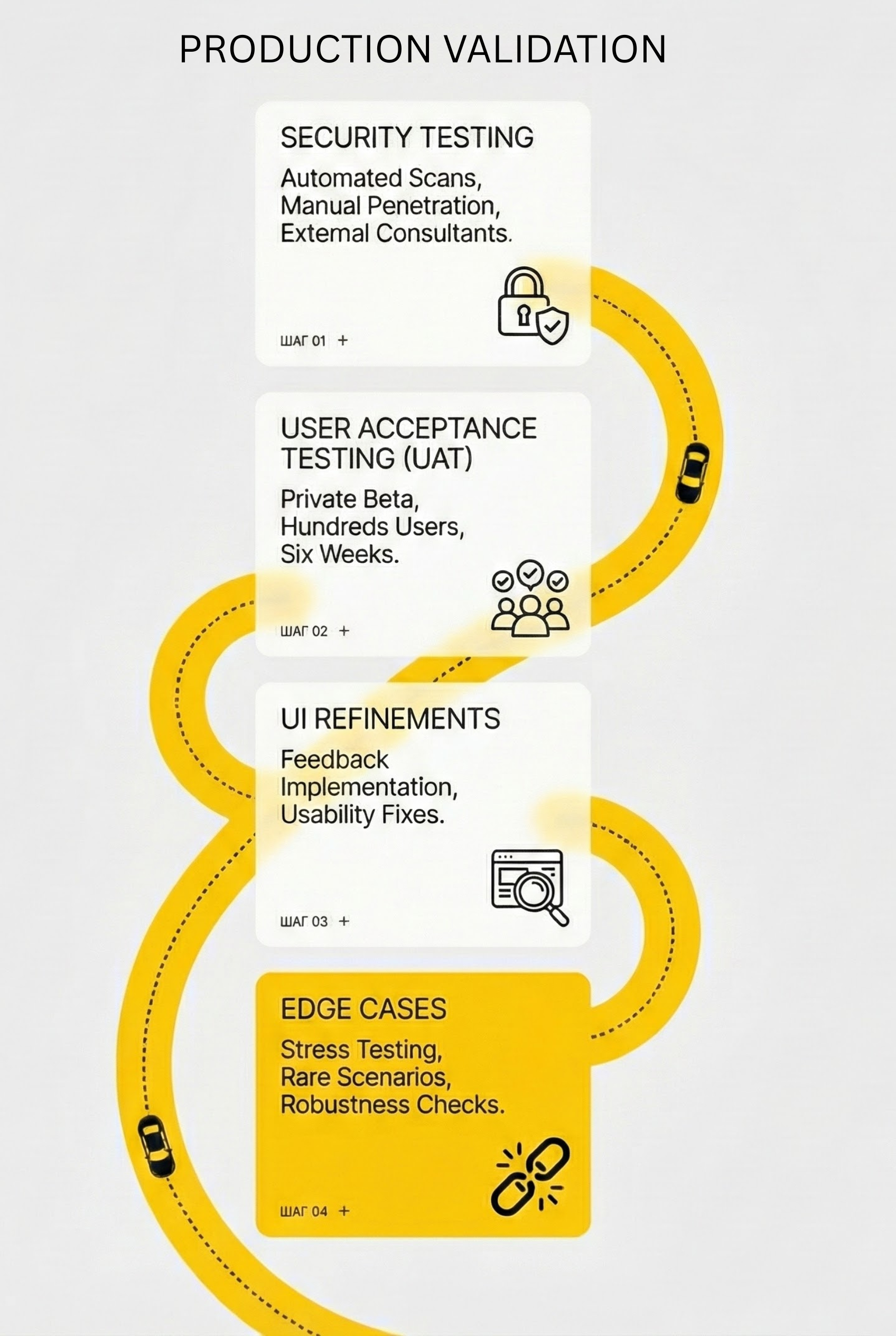

Security was a top focus, combining automated scans, manual penetration tests, and independent expert reviews to confirm a robust defense. User acceptance testing with hundreds of beta users provided vital feedback that shaped UI refinements and uncovered edge cases beyond internal testing.

Deployment and Infrastructure

We deployed the platform on cloud infrastructure designed for reliability and performance. The architecture includes load-balanced application servers behind a reverse proxy, providing redundancy and easy scaling.

The database setup uses a primary-replica model with automated failover to ensure continuous availability. Daily backups are securely stored offsite, and our automated deployment pipeline uses blue-green deployments to minimize downtime and risk. Monitoring tracks key metrics and alerts the team immediately to any issues for fast resolution.

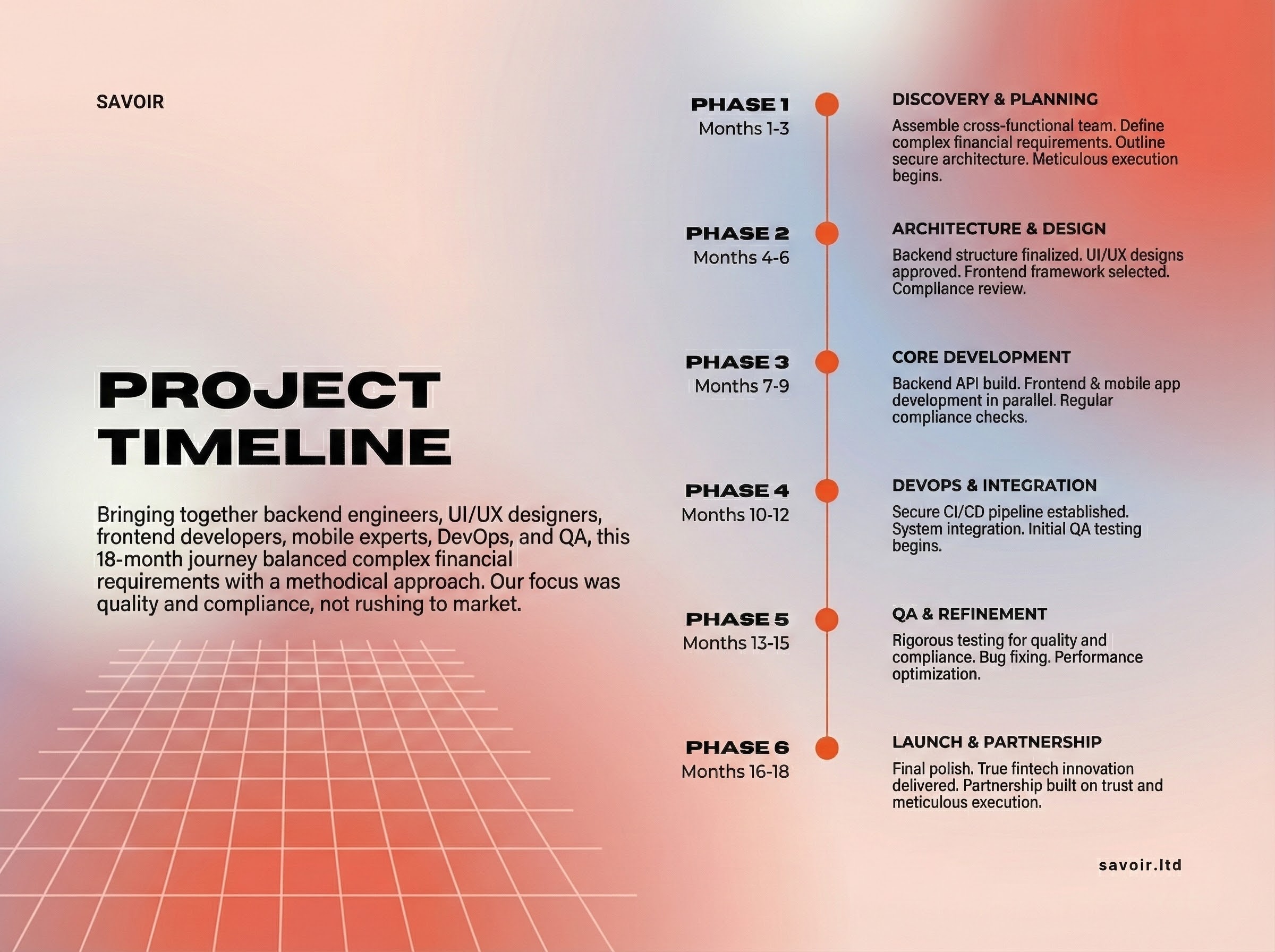

Timeline & Team

SAVOIR

Redefining Creative Excellence

INNOVATING BRILLIANCE

COMMITTED TO PATIENCE AND PRECISION IN FINTECH DEVELOPMENT.

Bringing together backend engineers, UI/UX designers, frontend developers, mobile experts, DevOps, and QA, this 18-month journey balanced complex financial requirements with a methodical approach. Our focus was quality and compliance, not rushing to market. True fintech innovation demands understanding the stakes—a value our client embraced wholeheartedly, enabling a partnership built on trust and meticulous execution.

We are technical architects and fintech specialists, united by one mission: to transform complex financial challenges into scalable, secure platforms — turning vision into operational reality.

At SAVOIR, we're fueled by the drive to redefine digital banking, not just building software, but creating white-label foundations that empower brands to launch confidently. We fuse robust engineering, intuitive design, and forward-thinking infrastructure into seamless solutions delivered with precision, backed by reliability.

Digibank Platform

Why SAVOIR ?

- Approach

- Focus

- Mission

- Components

Collaborative Process,

Transparent Communication

At Savoir, we believe great software and apps are built with empathy, insight, and clarity. Our approach is rooted in listening deeply, aligning early, and staying in sync — not just with the goals, but with the pace and energy of our clients. With Digibank, our process was fully collaborative, where every step was shared, reviewed, and aligned before moving forward.

Even without daily calls or meetings, we maintained consistent communication with the team via chat. Every architecture decision, feature flow, and user interface point was refined together, keeping transparency at the center of our workflow. That’s how we deliver software and apps that feel intuitive and secure from the inside out.

Clarity-Driven Execution

At Savoir, we approach every project with intention. From the very first wireframe to the final deployment, we keep the user, the brand, and the business goal at the core. Our focus is never just on “how it looks” — it’s always about what it does. With Digibank, every module was engineered to deliver secure, seamless functionality without complexity or friction.

We ensured that the architecture flowed logically, features were implemented simply, and every user flow had a clear purpose. This laser-sharp focus helped us build software and an app that doesn’t just perform well — it secures transactions, engages users, and scales with the brand’s evolving needs.

Our mission is to help businesses build meaningful digital platforms — ones that serve a function, spark connection, and support long-term growth. We don’t code for trends. We code for transformation. Every project we take on is guided by the belief that software and apps should feel like an extension of the brand — not just a tool, but a statement.

With House of Mavven, that belief was front and center. The website wasn’t just built to be “live” — it was built to elevate. From the way services are structured to how visuals flow through the page, our mission was to create a platform that empowers the brand’s voice and opens doors for global opportunity.

At Savoir, components aren’t just code modules — they’re building tools made for flexibility, function, and future growth. Every software and app we create is built with modular, reusable components that can adapt as the business evolves. These components are thoughtfully planned to ensure consistency across features, streamline backend management, and support long-term scalability.

For House of Mavven, we developed each section — from service layouts to insight-sharing modules — to work seamlessly together. The structure allows the brand to easily update content, add new offerings, or expand their site as the business grows. It’s a custom WordPress build with the freedom and strength of a long-term digital asset.

We build digital products that matter. From complex fintech platforms to consumer applications, our team brings the technical depth and design sensibility needed to create software that users trust and love.

TEAM SAVOIR